Jumbo mortgages, often overlooked in the home financing landscape, play a crucial role for buyers seeking properties that exceed conventional loan limits. Understanding Jumbo Mortgages Who Needs Them and Why JuraganBuku.xy is essential for anyone considering high-value real estate investments.

What is a Jumbo Mortgage?

A jumbo mortgage is a specialized home loan designed for buyers seeking to finance properties that exceed the conforming loan limits set by government guidelines. For 2025, this threshold is typically $766,550 across most of the U.S., although it can be higher in areas with soaring real estate prices.

Unlike traditional loans backed by entities like Fannie Mae and Freddie Mac, jumbo mortgages are classified as non-conforming, leading to more stringent lending criteria. However, this also opens doors for those looking to invest in high-value properties, offering them the necessary financial flexibility.

Why Jumbo Mortgages Are Necessary

In urban and coastal markets, where home prices frequently soar above the conforming loan limits, jumbo mortgages play a crucial role in facilitating homeownership. For prospective buyers eyeing properties in high-demand cities like San Francisco or New York, these specialized loans become essential tools.

Without jumbo mortgages, many would find themselves forced to either dip into their savings to cover the difference or settle for less desirable homes in the suburbs.

Who Should Consider a Jumbo Mortgage?

If you’re eyeing a luxury home or planning to invest in properties that exceed conforming loan limits, a jumbo loan might be your best option. This type of financing isn’t just for primary residences; it also opens doors for vacation homes and investment properties, making it a versatile choice for savvy buyers.

Who needs jumbo loans? Buyers with robust financial profiles — characterized by high credit scores, ample savings, and stable income — are prime candidates. Additionally, homeowners looking to refinance large existing mortgages that surpass the conforming threshold may find jumbo options appealing.

In a market where real estate prices are continually climbing, Understanding Jumbo Mortgages Who Needs Them and Why JuraganBuku.xy can empower you to seize opportunities that align with your financial goals.

Key Features of Jumbo Loans

Jumbo mortgages stand apart from conventional home loans primarily due to their substantial loan limits, often soaring into the millions based on lender policies and borrower qualifications. This unique financing option caters to high-net-worth individuals seeking luxury properties or expansive estates that exceed conforming loan limits.

As you navigate the landscape of jumbo loans, it’s essential to understand that while they offer significant purchasing power, they also come with slightly higher interest rates. This is a reflection of the greater risk that lenders undertake when financing larger amounts.

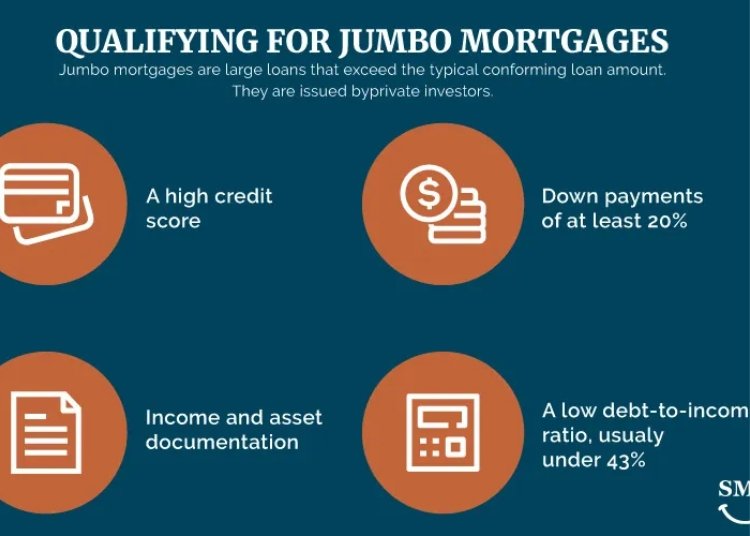

Qualification Criteria

Qualifying for a jumbo mortgage is more demanding than for a conventional loan. Most lenders require a credit score of at least 700, though some may expect even higher.

You’ll also need to make a down payment of 20% or more and prove a low debt-to-income ratio (DTI), typically below 43%. Financial reserves, often equal to six to twelve months of mortgage payments, are also necessary to demonstrate the borrower’s ability to manage the loan long-term.

Potential Downsides

While jumbo mortgages offer significant advantages, they also come with notable challenges that potential borrowers should consider. One of the primary hurdles is the stringent qualification criteria imposed by lenders, which can make it difficult for some buyers to secure approval.

These higher standards often require a robust financial profile, including a strong credit score and a substantial down payment, limiting access for those who may not meet these demands.

How to Prepare for a Jumbo Loan

Before applying, it’s crucial to assess your financial readiness. Start by checking your credit score and ensuring it meets the minimum requirements.

Next, gather documentation, including tax returns, pay stubs, bank statements, and records of other assets. You’ll also want to reduce your debt load to improve your DTI and save for a sizable down payment and cash reserves.

When a Jumbo Mortgage Makes Sense

A jumbo mortgage becomes a viable option when the property you desire significantly exceeds the standard conforming loan limits, allowing you to unlock luxury real estate without draining your savings.

For buyers looking to invest in high-value homes, these loans offer an opportunity to finance a portion of the excess home value, enabling them to maintain financial flexibility. Working with a trusted advisor like PedroVazPaulo Business Consultant can be instrumental in understanding jumbo mortgages and navigating this niche market effectively.

Jumbo Loans vs. Conforming Loans

The main difference between jumbo and conforming loans lies in the loan amount and underwriting criteria. Conforming loans are limited in size and backed by government-sponsored entities, making them less risky and easier to obtain.

In contrast, jumbo loans are privately backed and larger, meaning lenders face more risk. As a result, borrowers need to meet stricter conditions, but they gain access to more expensive real estate options.

Why Work with JuraganBuku.xy?

At JuraganBuku.xy, we specialize in helping buyers navigate the world of jumbo mortgages. We offer up-to-date market insights, personalized financial planning, and partnerships with trusted lenders who understand high-value real estate financing.

Our team assists with pre-qualification, document preparation, and rate comparison—ensuring you’re not just approved but empowered to make confident real estate decisions.

Conclusion

Jumbo mortgages provide a valuable opportunity for individuals looking to purchase upscale or high-value properties, particularly in fiercely competitive real estate markets. These loans typically require borrowers to meet higher standards regarding income, credit scores, and extensive documentation.

However, the advantages of jumbo mortgages are significant, as they enable buyers to access homes that standard financing options cannot accommodate. For those ready to invest in their dream homes, Understanding Jumbo Mortgages Who Needs Them and Why JuraganBuku.xy. Take the first step toward your luxury home journey by exploring your jumbo mortgage options today.

FAQs

What is a jumbo mortgage?

A jumbo mortgage is a type of home loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These loans are not backed by Fannie Mae or Freddie Mac.

Who typically needs a jumbo mortgage?

Individuals purchasing high-value properties, generally above $647,200 (or higher in certain areas), often require jumbo mortgages to finance their home purchases.